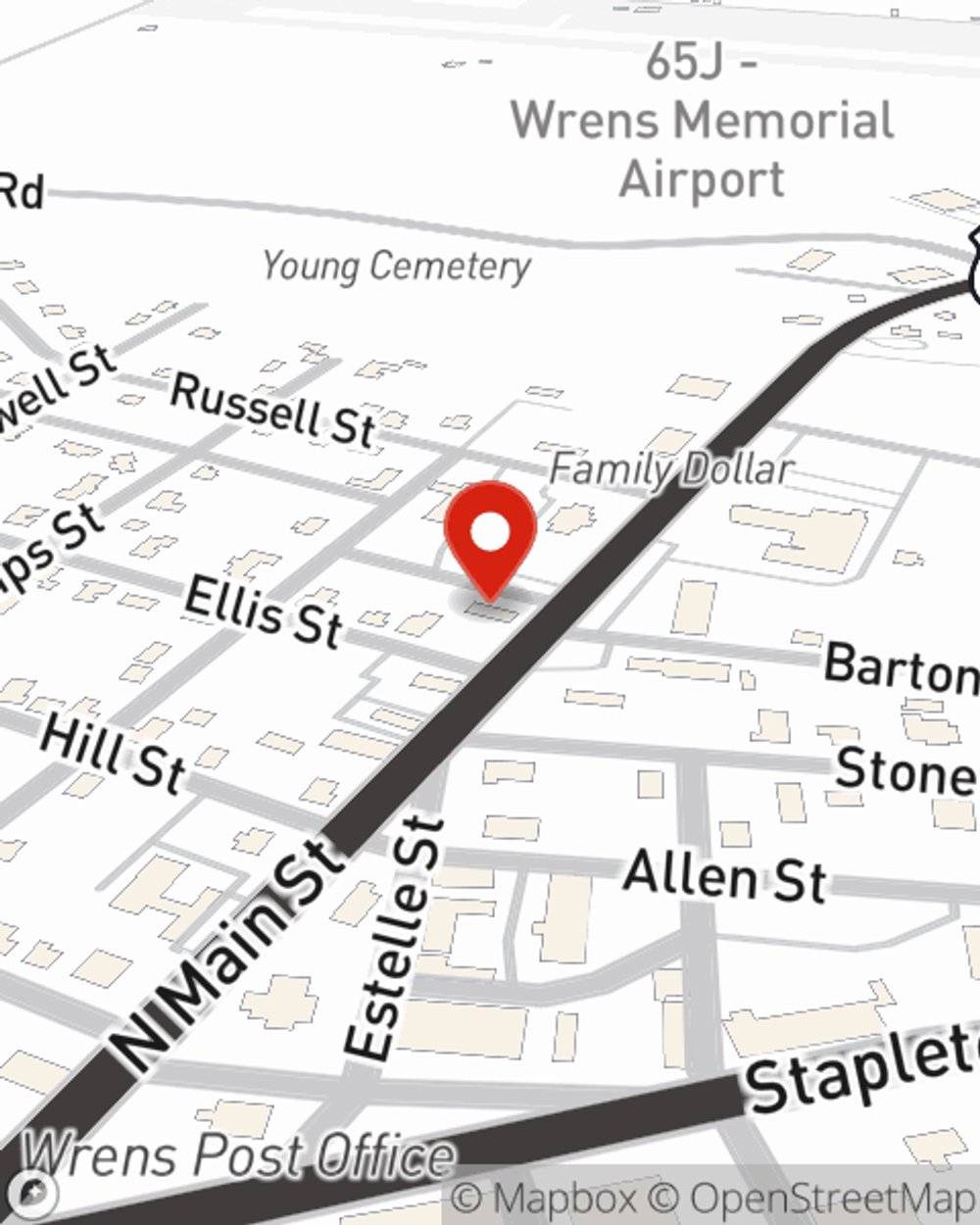

Condo Insurance in and around Wrens

Wrens! Look no further for condo insurance

Insure your condo with State Farm today

Home Is Where Your Condo Is

As with anything in life, it is a good idea to expect the unexpected and attempt to prepare accordingly. When owning a condo, the unexpected could look like damage to your condo and its contents from vandalism fire, lightning, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Wrens! Look no further for condo insurance

Insure your condo with State Farm today

Agent Lee Woods, At Your Service

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Lee Woods is ready to help you navigate life’s troubles with reliable coverage for all your condo insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If you have problems at home, Lee Woods can help you submit your claim. Keep your condo sweet condo with State Farm!

Fantastic coverage like this is why Wrens condo unitowners choose State Farm insurance. State Farm Agent Lee Woods can help offer options for the level of coverage you have in mind. If troubles like identity theft, wind and hail damage or drain backups find you, Agent Lee Woods can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Lee at (706) 547-2994 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.